EV startup Canoo has reached the revenue phase and announced limited production has started in Oklahoma with volume production still on track for a capacity of a 20,000 run-rate in the first quarter of 2024.

During Tuesday’s third quarter 2023 earnings call Canoo showed off three of its first made in Oklahoma Lifestyle Delivery Vehicles that are being delivered to the state of Oklahoma as part of an agreement to sell up to 1,000 Canoo EVs to the state.

Although relatively small, revenue is starting to flow in. “We generated revenues of approximately $519,000 in Q3 of 2023,” said Ramesh Murthy, Canoo Sr. Vice President and Chief Accounting Officer.

Related: More Canoo coverage

Chairman and CEO and Chairman Tony Aquila Announced Canoo’s Pryor, OK battery plant is now capable of a 20,000 run-rate and the new assembly line in Oklahoma City remains on schedule. “Today, we update the General Assembly system is on track to achieve the 20,000 unit run-rate for Q1 2024. Listen, we believe it’s essential for us to be disciplined when stepping our way into volume manufacturing with the right pace of investment and with our supply chain partners.”

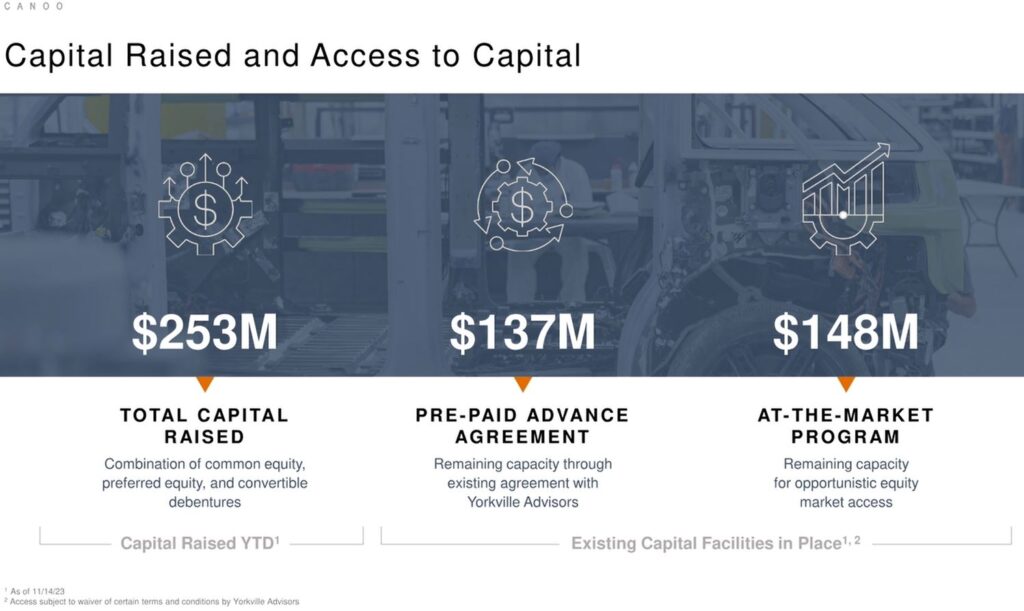

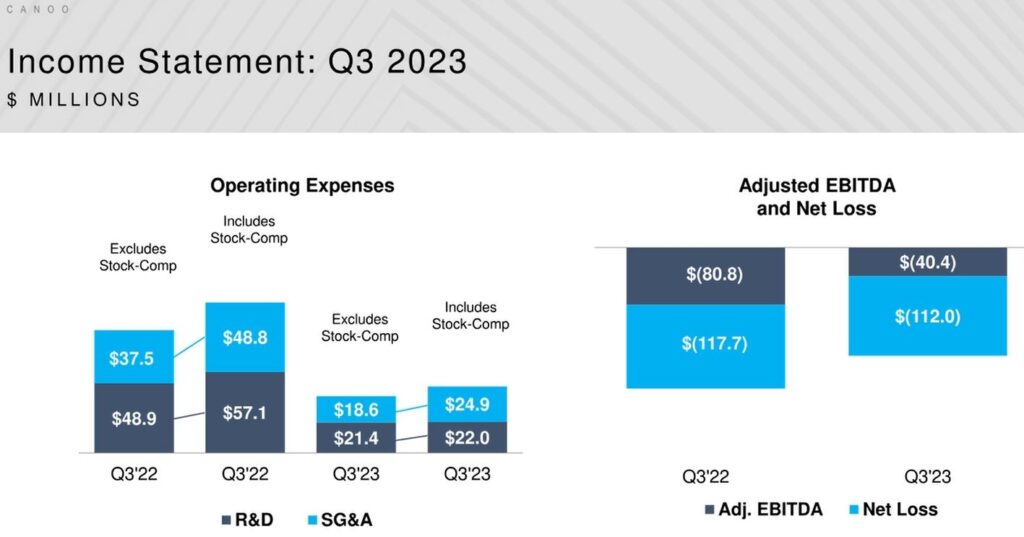

So far this year Canoo has raised $253 million in capital but its also burning through cash fast with a net loss of $112 million in the third quarter.

Canoo’s total order book has passed $3 billion with more than $750 million worth of committed orders. Committed orders from companies such as Walmart add up to more than 18 thousand EVs.

Aquila is bullish about enough money coming in to make it through the ramp up stage. “Into, you know, we’ll get our first set of incentives in the first of the year and you know when you’ve got great POs [purchase orders] from grade A credit and triple B credit, you know our spread very bankable to get advances on. However, we want to focus on this phase.”

Based on the number of committed orders, Canoo indicated it already has enough business to make it to break even stage if it can keep raising enough capital in the interim.

“Yeah. We start to really come to profitability, you know, to kind of break even around 14 to 16,000 units depending on the manual processes and the automation we’ve implemented.” said Aquila.

At the time this story was written Canoo stock had jumped 5.5% following the third quarter call in Wednesday morning trading.

For individual customers hoping to buy one of Canoo’s EV vans they’ve still got quite a wait since the company has made it clear its priority will over the next year or two will be fleet customers.

“Not only are our fleet customers contracted multiyear volume buyers with bankable credit profiles and are those who demand minimalism with maximum functionality and safety, these partners can help you fast forward generations of continuous. improvement, which will ultimately benefit our consumer customers, when we increase and expand our delivery to these additional markets,” said Aquila.

Editorial disclosure: The author of this post is a Canoo stockholder.