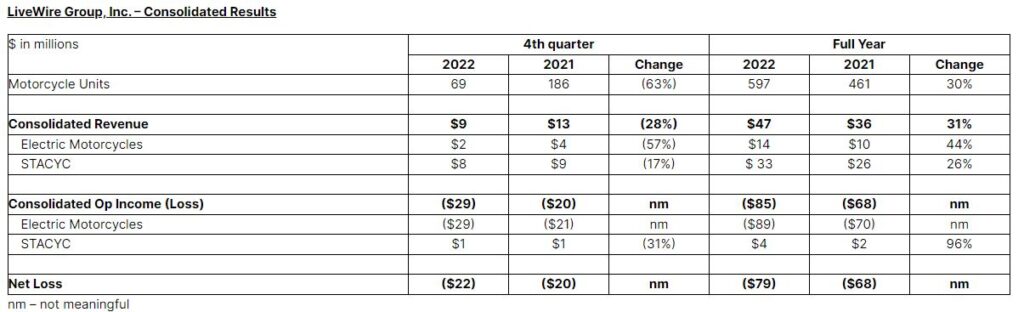

Harley-Davidson’s LiveWire brand saw its EV motorcycle sales revenue grow 44% year-over-year to $14 million in 2022, according to its 4th quarter earnings report.

Harley moved 597 LiveWires in 2022, compared to 461 in 2021, which is a year-over-year increase of 31%.

The LiveWire brand lost $89 million in 2022 but Harley expected LiveWire losses as it invests in development and ramps up EV operations.

Related: More LiveWire coverage

LiveWire revenue dropped 57% in the fourth quarter as compared to the same quarter in 2021. 2022 was a transitional year as Harley changed the branding and dealership structure for its EVs.

Harley is forecasting the LiveWire brand will have a 2023 operating loss of between $115 – $125 million as it prepares for volume production of its second EV, the S2 Del Mar.

Volume production of the S2 Del Mar is being readied at plants in Wisconsin and Pennsylvania. LiveWire’s sales growth projection for 2023 has a wide variance ranging from a low of 750 to 2,000 electric motorcycles.

The LiveWire brand nearly doubled its U.S. dealer network in 2022, growing to 75 locations. In part, because LiveWire is a separate brand, many traditional Harley dealers aren’t carrying the EV product line yet. When it was originally launched, the LiveWire One was branded as a Harley-Davidson. Now, the branding connection to Harley is being minimized.

Harley-Davidson said LiveWire is also on track to launch this year in Germany, the United Kingdom, France, the Netherlands and Switzerland.

Last year Harley spun off LiveWire into a publicly traded stand alone brand to raise additional capital, although Harley retains a large-majority controlling ownership.

While LiveWire continues to be a financial drag on Harley-Davidson, overall Harley expects revenue growth of 4 to 7% in 2023.

Harley finished 2022 strong, with a net income of $741 million for the year, which is up 14% from 2021 and exceeded the expectations of analysts.

View the full Harley-Davidson 2022 Year End Report slide presentation