EV startup Canoo (NASDAQ stock symbol GOEV) built 22 vehicles in 2023, with 17 of those being built in the fourth quarter, the company announced during its 4th quarter call on April 1, 2024.

Twelve Canoo EVs were delivered to customers including NASA, Kingbee and the State of Oklahoma; with ten being used for sales and demonstration purposes.

Related: More Canoo coverage

Among the early 2024 high-profile scheduled deliveries are six right-hand drive versions of the LDV 190 to the U.S. Postal Service. “Lookout for the first vehicle vehicles delivering your mail starting this May,” said Canoo Chairman and CEO Tony Aquila during the call.

In addition to the Postal Service, the U.S. Army is also evaluating Canoo EVs for potential orders.

Because Canoo is using driving-by-wire technology it’s relatively easy to create right-hand-drive vehicles, which Aquila says is sparking interest in Europe and is why the Postal Service is evaluating the EVs for potentially a larger purchase order. “We will showcase our right-hand-drive vehicles at several UK commercial vehicle fleet events in the coming weeks.”

Aquila said the company remains on track to reach a 20,000 run-rate capacity this year although Canoo likely won’t come anywhere close to building that many EVs in 2024. Instead, the startup expects to build somewhere in the neighborhood of 3,000 EVs in 2024 using what Canoo calls a stair-step approach.

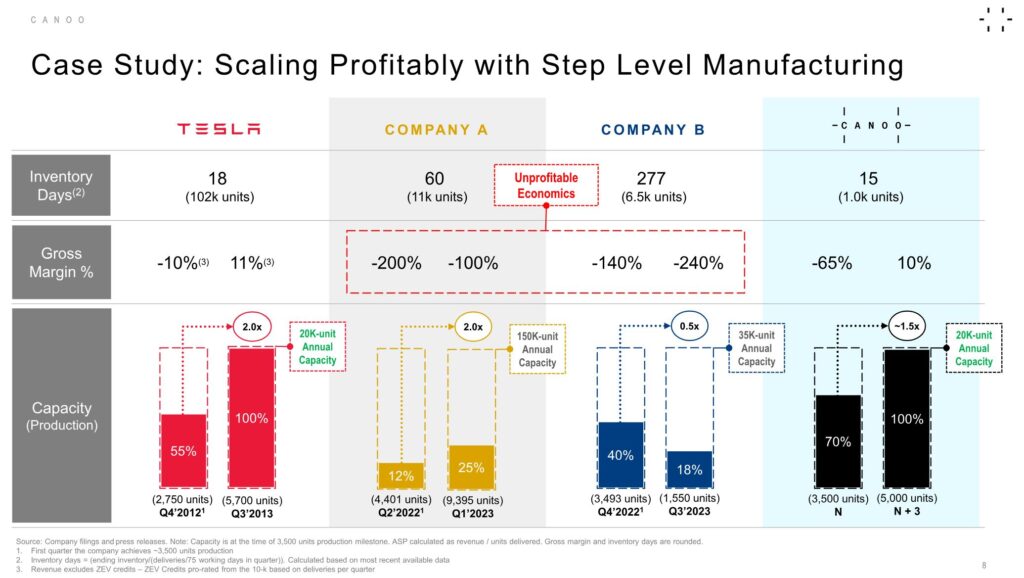

The idea is rather than burning through a bunch of capital in the beginning by building vehicles at a per unit loss to instead build a small number at a profit and then gradually increase the assembly line speed to avoid losses and quality defects.

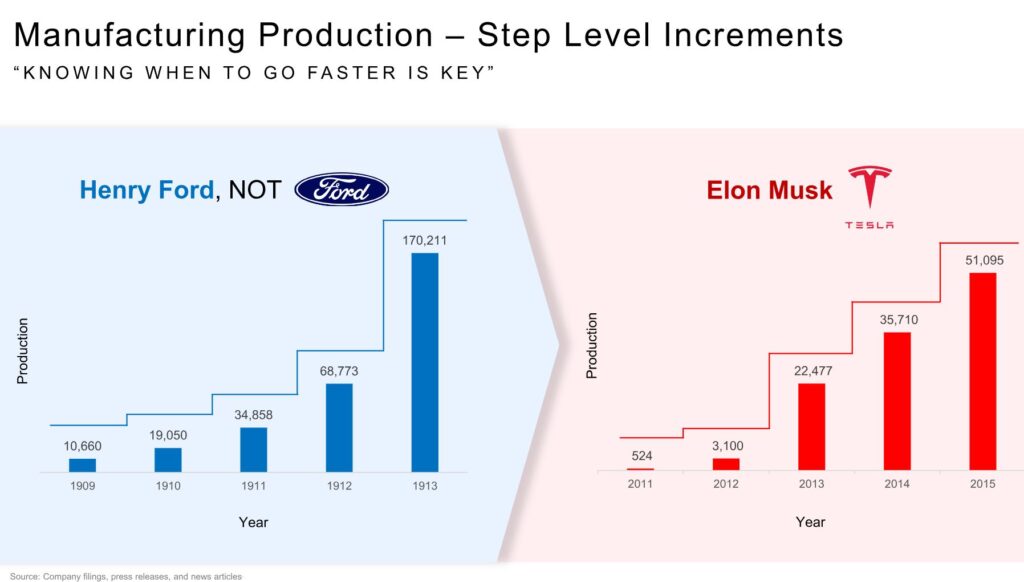

Aquila said Canoo is using the same basic playbook that Henry Ford and Tesla’s Elon Musk have used. “While it was chaotic and difficult, their phased approach was purely positive. As you can see [see chart image] as they moved from 3000 units and stepped up to a 20,000 unit run rate. They had their economics right.”

The CEO stressed he is very mindful of capital and wants to avoid the predicaments some other manufacturers have gotten themselves into by ramping up production too fast.

“If you look at the slide that we gave, an example of the other companies, it is very tough to make it up on volume when you get the foundation wrong and that’s why we minimize the number of parts, increase the amount of technology and our own,” adding, “this is the right way to do it. To get to the right economics and to be able to deliver a high quality product.

Canoo also snapped up some manufacturing assets at 20 cents on the dollar from Arrival Automotive UK Limited’s venture that failed, which Canoo says will allow it to further lower capital costs.

The startup has decided to steer clear of consumer customers for now, instead selling to fleet customers such as government entitities and businesses like Walmart.

Canoo has also been awarded a foreign trade zone designation, which gives it another leg up on getting per unit costs down.

The company is forecasting revenue of between $50 and $100 million in 2024 while it expects a cash burn rate of between $45 million and $75 million per quarter.

Despite that financial imbalance, the CEO expressed confidence he will be able to continue raising capital as needed. “We’ve been very effective at being able to take the market opportunities and reduce the spend that we would otherwise have done. We spent hundreds of millions less than others.”

Canoo also announced a $45 million dollar infusion from an unnamed foreign investor.

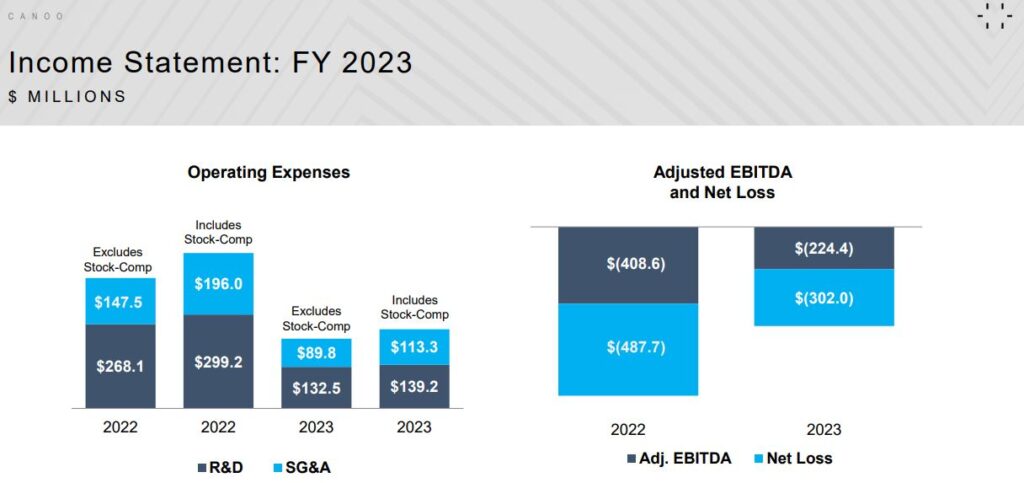

Some investors listening to the call weren’t impressed. In after-hours trading Canoo stock saw a big dip, although it did see a bit of a rebound in the next morning. When this post was published Canoo was still down overall to $2.80 from the previous day’s close of $3.87 [Current Canoo stock price]. Canoo lost $302.6 million in 2023.

After the call Canoo announced Jazeera Paints will be buying 20 of its EVs in 2024 with an option to buy 180 more.

Canoo Q4 And Fiscal Year 2023 Financial Results

The following is from Canoo’s April 1, 2024 news release:

- 45% or $184.2 million Annual Adjusted EBITDA Improvement from $(408.6) million in 2022 to $(224.4) million in 2023

- 40% or $11.9 million Reduction in Capital Expenditures versus already reduced 2023 Second-Half Guidance

- Secured USPS Agreement to Purchase Right Hand Drive LDV 190s

- Started Commercial Fleet Customer Deliveries

- Acquired Advanced Manufacturing Assets at Deep Discounts Reducing Anticipated Capital Expenditures by ~34%

- Oklahoma City Manufacturing Facility Designated as Foreign Trade Zone (“FTZ”) Opening International Expansion and Delivers up to $70.0 million in Estimated Vehicle Cost Savings and Duty Deferrals in 2024 and 2025

- Appointed Former NASA Chief Technology Officer Deborah Diaz and Veteran EV Transportation Leader James Chen to Board of Directors

JUSTIN, Texas, April 01, 2024 (GLOBE NEWSWIRE) — Canoo Inc. (Nasdaq: GOEV), a high-tech advanced mobility company, today announced its financial results for the fourth quarter and fiscal year 2023.

“In Q4 2023, we started our first commercial fleet customer deliveries from our Oklahoma City manufacturing facility while we continue to prepare the site for our 20,000 unit run-rate production target. Our strategy to purchase manufacturing assets at deep discounts creates immediate shareholder value. We recently announced our OKC facility has received FTZ designation. With positive customer validation, we are now focused on harmonizing our supply chain to align with our step level manufacturing goals while maintaining disciplined capital allocation,” said Tony Aquila, Investor, Executive Chairman and CEO of Canoo.

Fourth Quarter & Recent Business Updates:

- Completed 22 Vehicles for Full Year 2023 and 17 vehicles in Q4

- Delivered Vehicles to State of Oklahoma, Kingbee, and Zeeba in Q4, 2023

- Created 100+ Jobs in the State of Oklahoma to Scale Manufacturing

- $45.0 million Investment from Foreign Strategic Institutional Investor

- Unveiled the American Bulldog, builds upon rapid product development and real-world testing

- Conducted ~3,400 Miles of Customer Road Testing with LDV190 in Q4 and Reached over 20,000 Miles of Cumulative Testing

- Received First, Non-Dilutive Incentives from State of Oklahoma

Fourth Quarter and Fiscal Year 2023 Financial Highlights

- GAAP net loss and comprehensive loss of $29.0 million and $302.6 million for the three and twelve months ended December 31, 2023, compared to a GAAP net loss and comprehensive loss of $80.2 million and $487.7 million for the three and twelve months ended December 31, 2022.

- Adjusted EBITDA of $(54.6) million and $(224.4) million for the three and twelve months ended December 31, 2023, compared to $(60.5) million and $(408.6) million for the three and twelve months ended December 31, 2022.

- Net cash used in operating activities totaled $251.1 million for the twelve months ended December 31, 2023, compared to net cash used in operating activities of $400.5 million for the twelve months ended December 31, 2022.

- Net cash used in investing activities was $67.1 million during the twelve months ended December 31, 2023, compared to net cash used in investing activities of $66.8 million during the twelve months ended December 31, 2022.

- Net cash provided by financing activities was $288.5 million during the twelve months ended December 31, 2023, compared to net cash provided by financing activities of $290.4 million during the twelve months ended December 31, 2022.

2024 Business Outlook

Based upon our current projections, Canoo expects:

- Annual Revenue – $50 million to $100 million

- Cash Outflow – $45 million to $75 million per quarter

- Capital Expenditures – as we continue to seek opportunities to acquire distressed assets, capital expenditures guidance will be provided in future quarters

Canoo’s complete news release is available here.